Raleigh, NC Area Property Tax Rates

Welcome to the North Carolina Triangle and Capital!

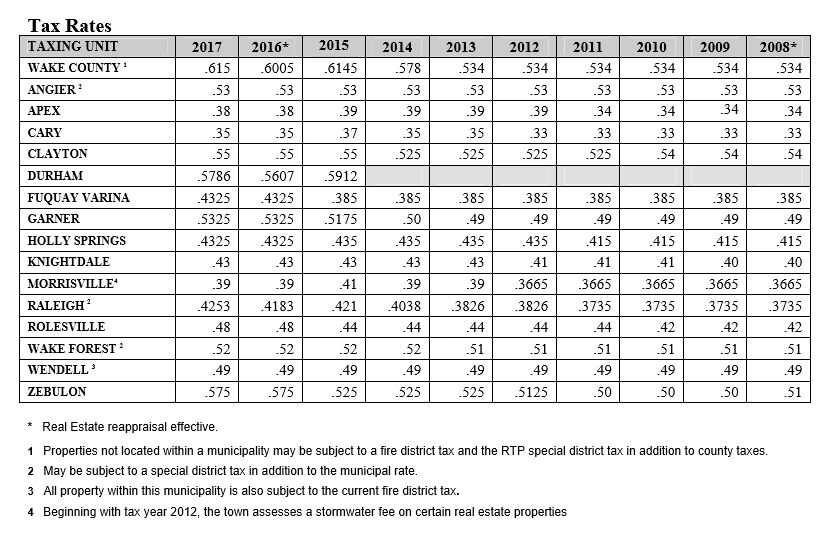

This is an easy to read property tax chart for Wake County, Raleigh, Cary, Morrisville, Apex, Holly Springs, Fuquay Varina, Wake Forest, Garner, Clayton, Angier, Rolesville and Zebulon, North Carolina.

The following property tax rates are for fiscal years 2008-2017.

Annual property taxes are calculated in the following manner:

Take the assessed tax value of the property, multiply it by the total tax rate, and divide by 100.

Your total tax rate if you are in a town will be the combined County and Town tax rate.

For example, if the home of interest has an assessed tax value of $200,000

and is in Raleigh, your total property tax rate will be .615 + .4253,

you will calculate 200,000 X 1.0403 / 100.

Your total should be $2,080.60 for this example.

Call me or email me if you need further clarification.

The assessed property values for the following towns were last re-evaluated in 2016.

Download the Wake County Tax Rate

2008 - 2017 Tax Rates & Fee Chart